Have you ever entered into an operating lease for a building, constructed leasehold improvements, and determined based on the provisions of the lease that you are legally obligated to remove the leasehold improvements at the end of the lease? If so, then you had an asset retirement obligation, also referred to as an ARO.

What is asset retirement in accounting?

Asset retirement is when property or capitalized goods are removed from service. This could be due to sale, disposal, or any type of removal, but once retired, the asset no longer has the utility for which it was originally acquired, constructed, or developed.

What is an Asset Retirement Obligation (ARO)?

An asset retirement obligation is the liability for the removal of property, equipment, or leasehold improvements at the end of the lease term. The accounting for these obligations is covered under FASB ASC 410, or Accounting Standards Codification Statement No. 410.

Under US GAAP, if a company enters into a lease for a building, constructs leasehold improvements, and determines based on the provisions of the lease that it is legally obligated to remove the leasehold improvements at the end of the lease, then the company has ARO. Typical examples of an ARO are when a store builds out the leased space to their specific layout or a business paints and updates a space for their branding. If the lease agreement requires the lessee remove shelving or repaint to a neutral color, the lessee has an ARO and should record the obligation to return to space to its original condition at the time the changes are made. Similarly, when a company leases land and installs underground tanks on the property, if the tanks must be removed at the end of the lease term, this is an ARO.

ASC 410: ARO accounting and environmental obligations

FASB ASC 410, Asset Retirement and Environmental Obligations, section 20 (410-20) contains the primary guidance from FASB on how to account for asset retirement obligations. Environmental liabilities accounting guidance is contained in ASC 410-30.

Generally, lease obligations imposed upon a lessee to remove leasehold improvements or remodeling they’ve done to return the leased asset to its original condition are asset retirement obligations and should be accounted for following the guidance contained in ASC 410-20.

ASC 410-20 and interactions between ASC 410 and ASC 842

ASC 410-20 centers on lessee obligations to return an asset subjected to lessee-constructed leasehold improvements to its original condition. Distinctively, ASC 410 does not apply to the underlying asset’s lease payments. Activities meeting the definition of either lease payments or variable lease payments for the underlying leased asset will be accounted for by the lessee under ASC 842.

This article offers a detailed example of how to account for an operating lease under ASC 842.

How to perform the accounting for an ARO

To account for this scenario under US GAAP, the company would record a liability for the cost to remove the leasehold improvements at the end of the lease term, and increase the asset value of the leasehold improvement by the same amount. The liability would be recorded at fair value, which is another way of saying it should be recorded at the present value.

Use our Present Value Calculator to determine the PV of your lease payments or ARO payments:

The ARO discounted liability increases over the lease term and this increase is recorded as an operating expense on the income statement. The recognized expense is usually referred to as “accretion expense”. Changes to an ARO, resulting from revised estimates of the ARO’s amount or timing, should be recognized by increasing or decreasing the ARO liability and the related asset.

What is accretion expense?

Accretion expense is the cost associated with an increase in a liability’s carrying value over time. Generally, accretion is recognized as an operating expense in the statement of income and often associated with an asset retirement obligation. The journal entry to record this cost would be a debit to accretion expense, offset by a credit to the ARO liability. (You’ll see this entry outlined in our example below).

Is it an ARO?

For illustration, let’s assume a company leases land with offices and equipment already present and the lease requires the lessee to remove the offices and equipment at the end of the lease term. Because the original condition of the land included the improvements as part of the leased assets, this is not an ARO. These estimated costs should be included in the initial lease liability and lease asset calculations.

In contrast, assume the lessee company leases the same land without the pre-existing offices and equipment, but the lessee has the option to add such improvements. The lease also states that any improvements must be removed at the end of the lease and that the property be returned to its original condition. Here, the obligation to remove the leasehold improvements is a direct result of the lessee’s decision to modify the leased land and results in an ARO.

Asset retirement obligation example and journal entries

Below, you’ll find a full example of how to account for an asset retirement obligation with journal entries. We’re using a leasehold improvement to demonstrate the example. Let’s begin with the terms of the lease and other assumptions.

Facts & assumptions

Assume a tenant enters into a 10-year operating lease for a building starting 1/1/2019 with monthly payments of $10,000 and annual escalations of 3%. The tenant constructs leasehold improvements totaling $500,000. The useful life of the improvements is 20 years. Under the terms of the lease agreement, the tenant must remove all leasehold improvements constructed at the end of the lease term. The company estimates that it would cost $50,000 to remove the improvements at the end of the lease.

Additional facts are as follows:

- The tenant has no renewal options under the lease.

- The improvements are not going to be used elsewhere (the tenant retires the improvements after the lease term).

- The tenant’s borrowing rate is 4%.

This arrangement contains both an operating lease and the cost to remove the leasehold improvement is considered an asset retirement obligation, or ARO. Remember – as we discussed above – the obligation to remove the leasehold improvement would have no effect on the straight-line rent amortization of the lease.

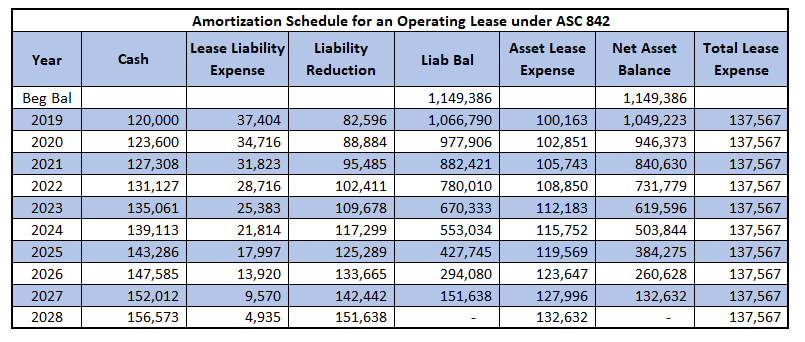

Here is a quick summary of how the operating lease would be accounted for under ASC 842 by recognizing straight-line expense according to the following amortization schedule:

ARO liability: Initial recognition and measurement

Since the agreement indicated the lessee has to return the property to its original condition before the lease began, this is an ARO, which means the tenant will need to record a liability representing the cost to remove the improvements. This liability has to be recorded at fair value at the end of the lease term. Specifically, we need to calculate the present value of the cost to remove the improvement today.

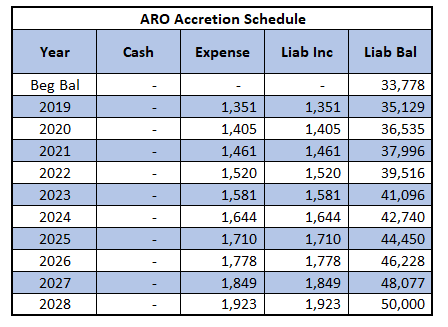

Let’s think about this for a second: it will cost $50,000 to remove the improvements 10 years from today, so if we are to record the liability in today’s dollars (at fair value), then the liability we will record should be less than $50,000. All we need to do is calculate the present value of a one-time payment of 50,000 in 10 years, discounted using the tenant’s borrowing rate. Applying the method explained here using Excel, we get the following accretion schedule:

Note that at the end of the 10th year, the liability would have accreted to $50,000, which is the amount required to remove the improvement at that time.

We now have everything we need to record our entries.

At lease commencement, upon constructing the leasehold improvements, the tenant will make the following journal entry:

| Account | Amount | |

|---|---|---|

| DR | Leasehold Improvements | 500,000 |

| CR | Cash | 500,000 |

To record leasehold improvements constructed

At the same time, the tenant will record the present value of the liability and corresponding asset reflecting the cost of removal of the leasehold improvement:

| Account | Amount | |

|---|---|---|

| DR | Leasehold Improvements | 33,778 |

| CR | Accrued Removal Costs | 33,778 |

To record leasehold removal costs at fair value

Subsequent ARO journal entries – Accretion of liability at end of year 1

The total value of the leasehold improvements is now $533,778, the sum of the cost of the leasehold improvements and the present value of the ARO. This will be depreciated on a straight-line basis over 10 years (the lease term). The ARO, on the other hand, is accreted using the ARO accretion table above The journal entry at the end of year one is as follows (once again from ARO accretion table):

| Account | Amount | |

|---|---|---|

| DR | Accretion Expense | 1,351 |

| CR | Accrued Removal Costs | 1,351 |

To record year 1 accretion

Note that while accretion expense of the removal liability is calculated the exact same way as interest expense using the borrowing rate, it should not be reported as interest expense on the statement of operations. Instead, it should be included as a component of operating income. So while depreciation expense from the leasehold improvement asset affects EBITDA, the accretion from the corresponding removal liability does not.

Final ARO journal entry: Retirement and settlement of ARO liability

At the end of the 10th year, the liability will have accreted to $50,000 and the entry to record the actual removal would be as follows:

| Account | Amount | |

|---|---|---|

| DR | Accrued Removal Costs | 50,000 |

| CR | Cash | 50,000 |

To record the final settlement of ARO liability