1. What is a tenant improvement allowance?

2. How tenant improvement allowances were accounted for under ASC 840

3. How to account for tenant improvement allowances under ASC 842

4. Tenant improvement allowances paid at or before commencement of the lease

5. Tenant improvement allowances payable after commencement of the lease

6. Tenant improvement allowances neither paid nor payable at commencement of the lease

7. Example of accounting for TIAs payable at commencement of the lease under ASC 842

8. Summary

What is a tenant improvement allowance?

A tenant improvement allowance (TIA) is generally defined as money paid by a landlord/lessor to the tenant/lessee as reimbursement for the construction of leasehold improvements, such as modifications to commercial real estate. TIAs may also be paid directly to vendors on behalf of the lessee. TIAs are commonly seen stated in the lease agreement as either a per-square-foot amount or a lump sum.

A lease incentive is a payment made to the tenant or on the tenant’s behalf by the landlord. This includes reimbursements for moving expenses, payments for tenants to break existing leases, and payments for TIAs. Because TIAs typically are not repaid to the landlord, they are a common type of lease incentive and must be accounted for in accordance with lease guidance.

The guidance under US GAAP includes the current FASB lease accounting standard, ASC 842, as well as the previous standard, ASC 840. In this blog, we will walk through how to account for TIAs under ASC 842 and contrast the accounting with ASC 840.

How tenant improvement allowances were accounted for under ASC 840

Under ASC 840, when a lessee received a TIA, they were receiving a lease incentive. ASC 840-20-25-6 stated that lease incentives shall be recognized as reductions to rent expense by the lessee (reductions to rental revenue by the lessor) on a straight-line basis over the term of the lease.

Therefore, the journal entry for a lessee at lease inception was to record the payment as a debit to cash and an offsetting credit to a lease incentive obligation liability, which is amortized (as a reduction to rent expense) over the life of the lease. Sometimes, the TIA may not be received immediately, and in those cases, the lessee would debit accounts receivable.

We have seen some companies debit cash and credit leasehold improvements. This is a common mistake, as incentives received should not be netted against leasehold improvements. Leasehold improvements are accounted for as fixed assets, separately from the funds received as a lease incentive.

How to account for tenant improvement allowances under ASC 842

Under ASC 842, TIAs are still classified as incentives, but are no longer reported as a lease incentive obligation liability to be amortized over the life of the lease. Instead, they are reflected in the initial measurement of the right-of-use asset and sometimes the lease liability at the inception of the lease, depending on when the allowance is received.

When initially adopting ASC 842, any unamortized lease incentive obligation liabilities are eliminated and reclassed to the new ROU asset’s opening balance. After initial implementation of the new standard, TIAs will continue to be recognized in the ROU asset and potentially lease liabilities.

ASC 842 describes lease incentives as “paid” or “payable” depending on the timing of their receipt. This article uses the same terminology and describes how to account for both types.

Tenant improvement allowances paid at or before commencement of the lease

TIAs may be paid to the lessee prior to or at commencement of the lease. Per ASC 842-20-30-5, these incentives are accounted for as a direct adjustment to the ROU asset’s opening balance. The ROU asset is initially equal to the lease liability, which is calculated as the present value of future payments. That balance is adjusted by various items, including a reduction in the amount of an incentive or TIA paid at or before commencement. Therefore the existence of this type of allowance will lower the ROU asset.

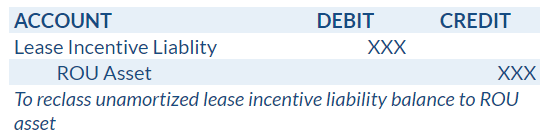

In the month/period of transition to ASC 842, any unamortized balance of a TIA is debited to remove the lease incentive liability from the balance sheet and reclassed to the ROU asset’s opening balance with a credit:

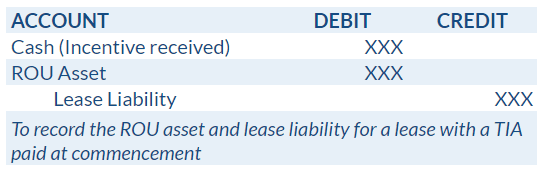

After the transition, TIAs received at lease commencement are recognized as a debit to cash and adjust the initial ROU asset recognized. The remaining line items to record a new lease are a credit to the lease liability and a debit to the ROU asset, adjusted to equal the initial liability balance less the TIA received.

Tenant improvement allowances payable after commencement of the lease

Often, TIAs are not paid as a sum before or at the commencement of the lease term but rather received as a reduction of rent payments in periods when the improvements occur. If the improvement allowance is paid after the lease’s commencement date, the payments will be factored into both the lease liability and ROU asset measurement.

The lease liability is calculated as the present value of all future payments, including those received for the allowance. As the timing of cash flows is key to a present value calculation, the payments for improvements will be reflected in the periods they are expected to be received during the lease term and netted with the rent payments for that period. The lease liability will be lower due to factoring in the expected cash receipts, and subsequently, the ROU asset balance will also be lower.

See below for an example of how to account for TIAs payable at lease commencement.

Tenant improvement allowances neither paid nor payable at commencement of the lease

ASC 842 does not provide guidance on how to treat incentives whose amounts and timing of receipt are dependent on future events. One approach to account for this situation is to determine if the lease terms include a maximum level of reimbursement and whether the lessee is reasonably certain to incur these costs. If this is the case, the maximum amount can be treated as an incentive payable recognized through a reduction of the lease liability and ROU asset.

Another option may be to wait until the reimbursable costs have actually been incurred and then reduce the ROU asset and lease liability by that amount. The reduction of the ROU asset is then recognized prospectively over the remainder of the lease term. Alternatively, a one-time adjustment to expense could be recognized as if the paid or payable amount was known at lease commencement.

Example of accounting for TIAs payable at commencement of the lease under ASC 842

To illustrate the required journal entries and calculations for a TIA payable at lease commencement, let’s assume the following facts:

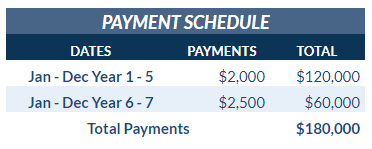

- Lease Term: 7 years

- Base Rent: $2,000 monthly payments (in advance) in years 1-5, and $2,500 monthly payments (in advance) in years 6-7

- Discount Rate: 4.5%

- Lease Classification: We’ll assume this lease is an operating lease for this example

- Incentive: Up to $1,000 TIA for leasehold improvements, due from lessor 6 months into year 1

- Leasehold improvements: The tenant expects to spend $1,500 for leasehold improvements.

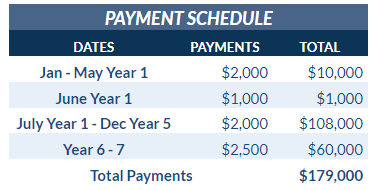

The lessee first creates a payment schedule of future cash flows showing when the rent payments will be made:

From the facts above, the lessee expects to spend $1,500 for leasehold improvements. The expected cost of the improvements is over the maximum amount of TIA, so the lessee includes the full $1,000 TIA as an offset to the rent payment for the sixth month of the lease agreement. (Note: The leasehold improvements are accounted for separately from the lease, through the lessee’s routine fixed asset accounting process). The lessee updates the payment schedule to reflect the expected TIA receipt:

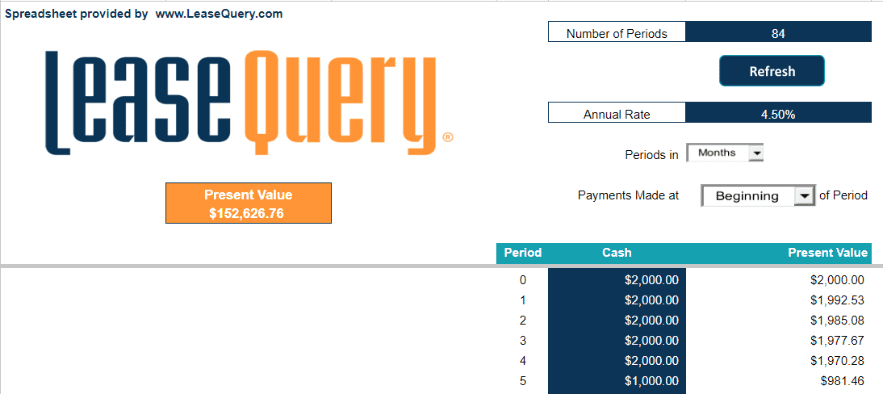

Next, the lessee calculates the opening balance of the lease liability and ROU asset as the present value of the future expected rent payments netted with the TIA they are reasonably certain to receive 6 months into the lease.

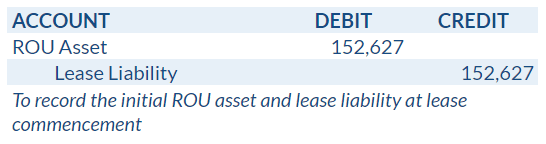

The lessee then books a journal entry to record the initial ROU asset and lease liability with a debit and credit in the amount of the present value calculated above, including the expected TIA in month 6.

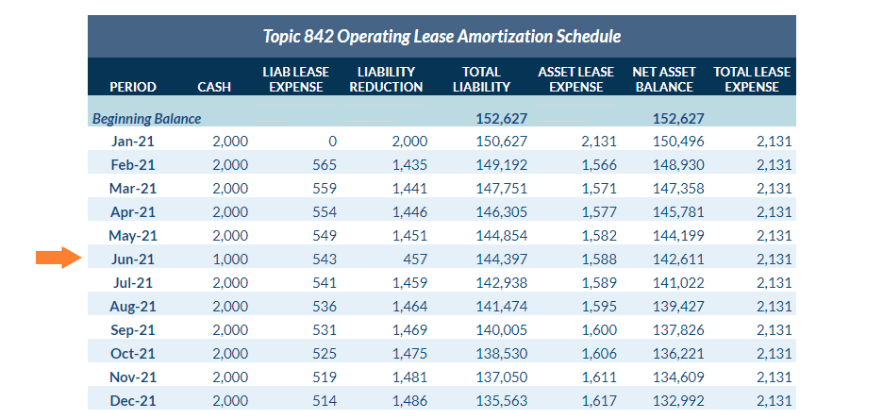

The lease liability and ROU asset are amortized according to the amortization table, a section of which is shown below.

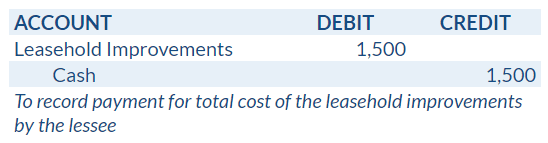

The lessee records the leasehold improvements at the time the improvements are made for the amount the lessee pays through their normal fixed asset accounting process and depreciates them over their useful life:

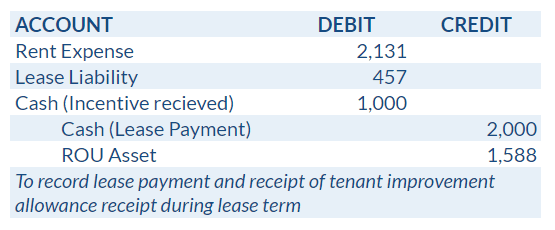

Then, in month 6 when the TIA reimbursement is received, the lessee records the monthly lease amortization entry, the lease payment, and the receipt of the incentive.

Summary

TIAs are a type of lease incentive. Under ASC 840 they were recognized as a reduction to rental expense on a straight-line basis with an offsetting credit to a lease incentive liability on the balance sheet.

Under ASC 842 TIAs paid at lease commencement are now recognized through a reduction to the ROU asset. If the TIA is paid later during the lease term, it is recognized as a reduction to both the liability and the ROU asset. Any unamortized lease incentive liabilities will be reclassed to the ROU asset’s opening balance at initial transition.